Think 2014 tax forms are bad? Here come the 1094 and 1095 for 2015! | Brio Benefits

By Bill Olson, Chief Marketing Officer at United Benefit Advisors

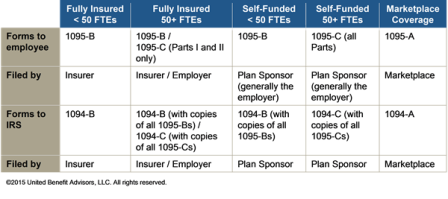

Our recent blog reviewed the highlights of the new employer and insurer reporting requirements. UBA has created this quick reference chart to help you sort out who should use which form, and when:

For comprehensive information on coverage requirements, due dates, special circumstances, controlled groups and how to complete the forms—including sample situations—request UBA’s PPACA Advisor, “IRS Issues Final Forms and Instructions for Employer and Individual Shared Responsibility Reporting Forms”.