PPACA’s Impact on How CDHPs and HSAs Work Together | New York Employee Benefits

Bill Olson, Chief Marketing Officer at United Benefit Advisors

There are many additional factors that will impact an employer’s HSA contribution strategy, says Mark Sherman, Principal of LHD Benefit Advisors, a UBA Partner Firm. Sherman says such factors include the deductible amount, the employee premium contribution, the out-of-pocket maximum, and whether there are other types of plans offered.

“When HSA products were new, the employer could take the premium savings and fully fund the deductible. Now, however, premium reductions are not as great as they once were. As premiums increase, employers naturally opt to put their contributions toward premiums first and will slowly reduce their HSA funding to the point where, in some cases, it becomes entirely the employee’s responsibility,” says Brian M. Goff, President & CEO of Insurance Solutions, another UBA Partner Firm.

The CDHP Link

The survey results indicate a correlation between enrollment in HSAs and CDHPs, linking higher HSA contributions to increased enrollment in the cost-saving plans.

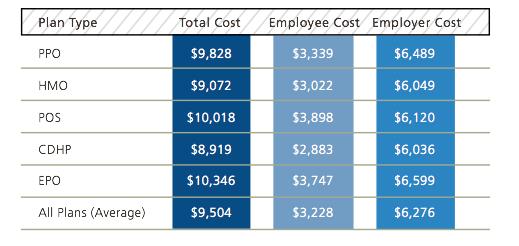

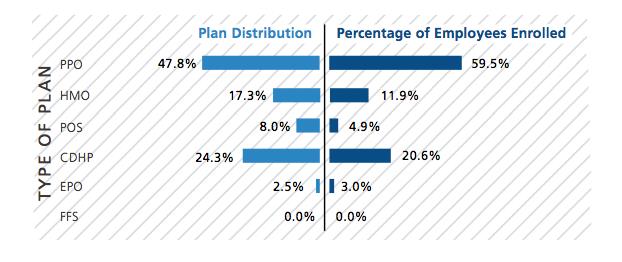

CDHPs have proven to generate cost savings, according to UBA surveys. The average annual health plan cost per employee for all plan types in 2014 was $9,504. In fact, CDHPs appear to have the lowest annual costs per employee, specifically 6.4 percent less expensive than average. In contrast, preferred provider organization (PPO) plans cost 9.7 percent more than CDHPs, yet they continue to dominate the market in terms of plan distribution and employee enrollment.

“While CDHP offerings are up 8 percent from 2012, they are largely unchanged from 2013,” says Les McPhearson, CEO of UBA. “From an enrollment standpoint, however, CDHPs have seen increases of more than 30 percent in the last two years (15.6 percent to 20.6 percent), despite overall decreases in employer contributions to HSAs. For large employers and some industries, even modest increases in HSA contributions can be a key part of the puzzle in migrating employees to lower cost CDHP plans.”

To read the full press release announcing the latest findings related to HSA funding, click here.

Topics: health plan benchmarking, CDHPs, PPACA Affordable Care Act, health savings account, HSA, consumer-driven health plan, 2014 Health Plan Survey, HSA funding

Tags: benefits broker new york, employee benefits new york, employee beneftis new york, health insurance, NY Employee Benefits, NYC benefits broker